The use of banking applications on cell phones has grown in recent years. Many banks have invested in mobile banking strategies (Laukkanen and Kiviniemi, 2010), which include improving banking applications that provide customers with new benefits and increased satisfaction. As a product manager, I also hope the users can rely on the applications I designed and build habits of usage. Once a habit is formed, most individuals will begin to respond instinctively. That is, their initial reaction will be perceptual rather than intellectual. As a result, the Hook Model is used in the design of many popular applications among young people, such as TikTok in the short video segmentation, Keep in the fitness segmentation. However, is the Hook Model suitable for financial application design? For example, Nordea mobile? In this blog, I will discuss both the benefits and the risks.

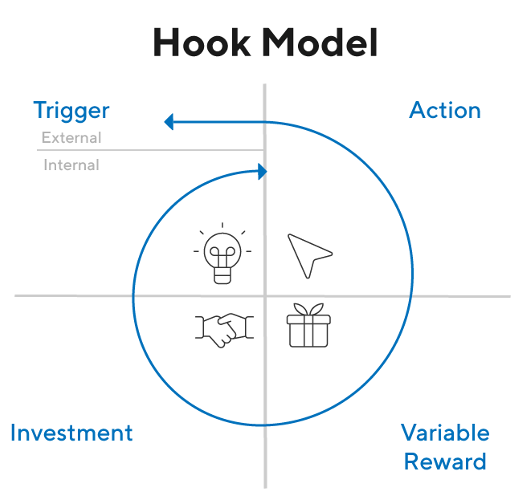

First of all, what is the Hook model? It is a way of describing a user’s interactions with a product as they pass through four phases: a trigger to begin using the product, an action to satisfy the trigger, a variable reward for the action, and some type of investment that, ultimately, makes the product more valuable to the user. As the user goes through these phases, he builds habits in the process (Eyal, 2014).

How does the Hook Model apply to a financial application? Firstly, the external or internal trigger is the actuator of behavior. It prompts the activity, which eventually becomes a habit. Users’ money, particularly financial investments, is controlled with financial applications. The majority of users will frequently monitor the status of their investments. It easily becomes a habit.

The second thing is Action. An action was taken in anticipation of receiving a reward. The users will feel safe when they see the number of money in the app. If the investment is successful, the users will be more willing to open the app. It is the third step called variable reward. The problem that is solved as a result of the action done strengthens the behavior cycle.

The last part is Investment which is a future-oriented action that improves a product or service. The user’s investment in a certain product is relevant to the user’s expectation of long-term rewards. Users’ input includes investing time, money, and social relations. Money is a strong bond between users and banks or other financial institutions. When you save money or implement some investing in a bank, you will never forget to open the apps.

However, there are still some risks when we apply the Hook Model simply to financial applications. The risks make them harder to be designed like normal applications. Here I want to highlight several of them.

- The design logic is different due to the different purpose of business.

We learned from our client that traditional banks, unlike emerging Internet companies, will not develop their business based on applications as the center like TikTok. At this time, an application may only be a supplement to the core business on mobile platforms.

Because the financial system is complex, product reliability is more important than customer experience. For banks or other financial institutions, safety, reliability, and stability are the primary considerations in the applications design. Financial products need to consider the overall plan at the beginning. Once determined, there is little possibility of adjustment in the future. It also causes the embarrassment of the entry point of user experience design. The designers must consider the overall situation in the upstream stage of product development and update the experience in a later stage.

Therefore, before designing, we should always consider what our client actually cares more about, for instance, which target customer segmentations the mobile bank applications are mainly for, and what are the characteristics of these target customers? What kind of business do we need to support in the application, and accordingly, how the original business needs to be adjusted? Is the new business model better for the customer experience? What about the final conversion rate? Is there an increase in revenue? - The customers’ demand for actual benefits has a higher priority than the customer experience

We can imagine and compare the following two scenes. When you go to a restaurant with all 5 stars reviews, but you notice that the waiter’s attitude is awful, you will consider leaving. If you don’t eat at this restaurant, you have many other choices. However, when it comes to the financial business, it is a totally different story. You go to the bank to apply for a house loan, and even if the clerk is your ex who speaks harshly to you and ridicules your low income, you will still endure your anger and insist on finishing your business, because if she doesn’t approve your loan, other banks may also not approve it. Therefore, we must provide value to users. Customer experience optimization is frequently an afterthought.

References

Eyal, N (2014), Hooked: How to Build Habit-Forming Products. London: Portfolio Penguin

Laukkanen, T. & Kiviniemi, V. (2010), The role of information in mobile banking resistance, International Journal of Bank Marketing, 28 (5), 372-388.